Thermomodernisation allowance

What is the thermal modernisation allowance

he thermal insulation allowance is a project prepared for owners of single-family buildings, that is detached, semi-detached, terraced or group housing. Whereby, expenses incurred on construction materials, equipment and services in respect of the execution of the thermo-modernization undertaking are withheld from the personal income tax base (that is from income). The expenses for building materials, equipment and services are those specified by the Minister of Investment and Development in the above regulation.

This project aims to reduce the energy demand of the building and includes the following measures:

- improvements that will reduce the energy demand for heating and domestic hot water and for heating in residential buildings, by way of illustration external wall insulation, replacement of window frames,

- improvements that will reduce primary energy losses in district heating networks and the local heat sources supplying them, provided that the residential buildings to which the energy is supplied from these networks meet the energy saving requirements laid down in the building regulations or measures have been taken to reduce the consumption of energy supplied to these buildings, for instance replacement of a boiler in an insulated building.

- technical connections to a centralised heat source, such as a district heating substation with temperature programmer,

- total or partial replacement of energy sources with renewable sources, such as photovoltaic, heat pump or high-efficiency cogeneration.

Heiztechnik delivers a wide range of equipment that meets the requirements for thermomodernization allowance being granted.

According to the Annex to the Regulation of the Minister of Investment and Development of 21 December 2018. (item 2489) in the List of types of building materials, equipment and services related to the implementation of thermomodernization projects, Heiztechnik equipment are available in the following places.

- Building materials and equipment:

In point:

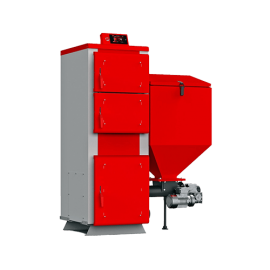

6) a solid fuel boiler meeting at least the requirements specified in Commission Regulation (EU) 2015/1189 of 28 April 2015 implementing Directive 2009/125/EC of the European Parliament and of the Council with regard to ecodesign requirements for solid fuel boilers (O J EU L 193 of 21.07.2015, p. 100);

Pellet boilers https://heiztechnik.pl/en/pellet-cookers/

Coal boilers https://heiztechnik.pl/en/cookers-for-eco-pea-coal/ and in subpara:

11) heat pump with accessories

Heat pumps https://heiztechnik.pl/en/heat-pumps/

The entitlement to the thermomodernization allowance is granted to the PIT taxpayer (settling PIT according to the tax scale and 19% tax rate – the so-called flat tax), owner or co-owner of a single-family residential building in which the thermomodernization project was or is performed.

The thermomodernization allowance may also be used by:

- taxpayers paying lump sums on registered income (both on income from business and from lease, tenancy or other similar agreements).

- natural persons subject to PIT or a flat-rate tax on registered incomes, who receive income from the sale of processed products from their own cultivation, breeding or rearing.

Under the thermomodernization allowance, no more than PLN 53,000 may be deducted in respect of all thermomodernization undertakings carried out in individual buildings of which the taxpayer is an owner or co-owner. Accordingly, this limit (PLN 53,000) applies to the taxpayer irrespestive of the number of thermomodernization projects carried out in particular years.

Such expenditure shall be determined solely against invoices issued by a taxable person for goods and services who is not exempt from that tax.

An expense may be deducted together with value added tax insofar as this tax has not been deducted by the taxpayer under the Value Added Tax Act.